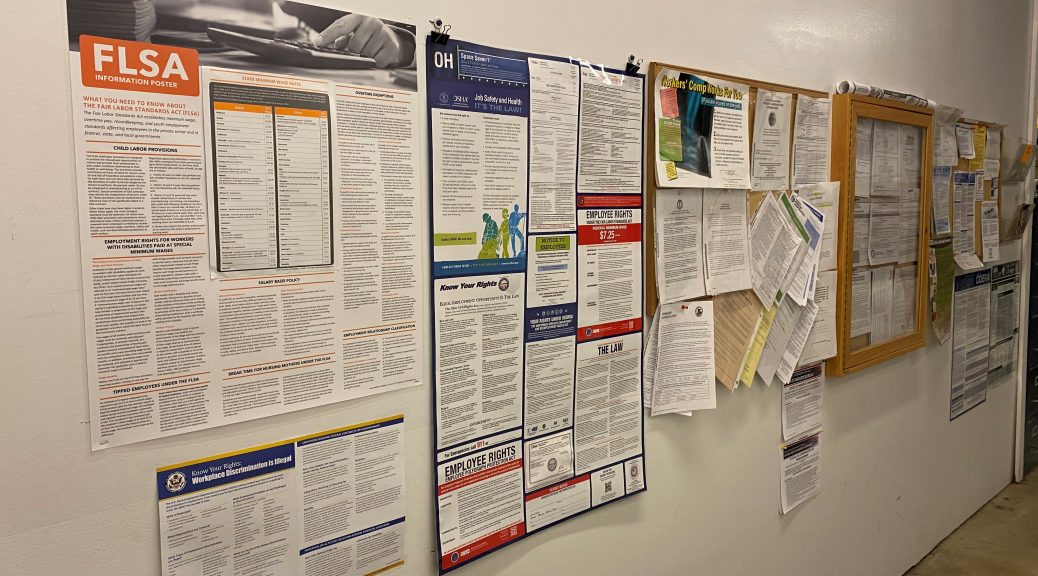

Employers must take note that the federal government has been busy updating several mandatory workplace posters. In April 2023, two posters were updated. First, the Department of Labor (DOL) released an updated “Minimum Wage” poster to include revised information concerning employees’ rights under the PUMP Act (Providing Urgent Maternal Protections for Nursing Mothers Act). This poster must be updated in order to meet the mandatory Minimum Wage posting requirements and prior versions do not comply. The new FMLA poster can be downloaded here.

Second, for employers with 50 or more employees, the DOL also updated “Your Employee Rights Under the Family and Medical Leave Act” poster. Not much has changed in the poster, but there have been some minor language changes in wording referring to employees and employers such as “may” or “must” in connection with requests for FMLA leave. The poster also includes a QR code that can be scanned to obtain additional information about how to file a complaint with the DOL It is recommended that employers update to the newest version of the FMLA poster, even though prior versions of the FMLA poster (dated April 2016 and February 2013) still meet compliance requirements.

The DOL provides free electronic copies of all the required posters and some posters are available in languages other than English. Posting requirements vary by federal law, meaning that not all employers are covered by each of the DOL’s laws and thus may not be required to post a specific notice. For example, small businesses (under 50 employees) are not covered by the Family and Medical Leave Act and thus would not be subject to the Act’s posting requirements.